Ford Accident Management is a new model, developed by Ford to counter the increases seen in the total cost of repair claims caused by ‘claims farming’.

These ‘added’ costs have been felt by the public in the form of higher premiums on their car insurance.

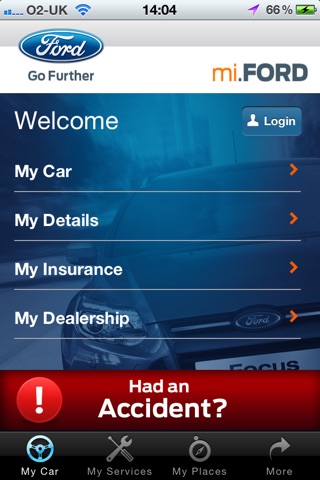

Ford Accident Management is free to any Ford customer.

The Ford model offers cost transparency to the Insurers, repairers and customers.

Ford Motor Company will not receive any direct revenue, nor receive or pay any referral fees (claims farming) with regards to the programme. This will significantly reduce the total cost of repair.

Ford recognises that in some cases there is a real need for Personal Injury assistance, and in such cases will refer the customer to a reputable firm of solicitors (for no fee) who will deal with the case at a reduced cost to the Insurance company involved.

Similarly Ford will be replacing the normal credit hire model with a flat fee model, removing any inducement for the repair process to be longer than it needs to be. The savings on hire due to less time in the bodyshop will be seen by the insurance companies.

Ford sees its revenue stream coming from potential increases in parts sales, car sales and increased volumes in Ford Rental hires.

The Ford model largely reflects the recommendations set out in the House of Commons Transport Committee report.

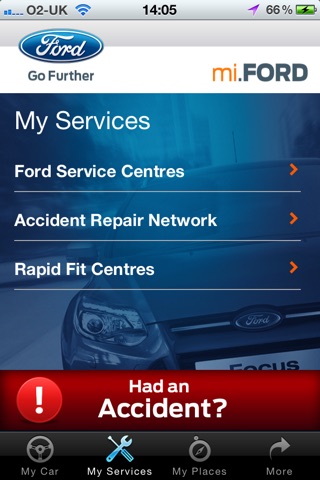

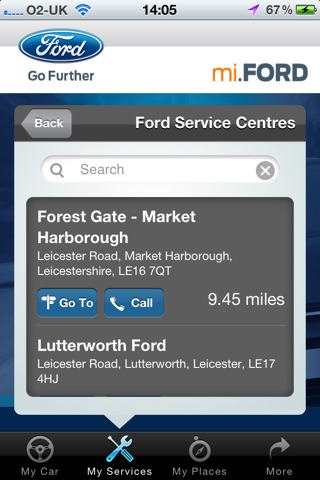

Benefits to our customers include, a single free phone number for life, vehicle recovery, available whatever the age of the Ford vehicle and whether the customer is a driver or a passenger. The Repair will be carried out by a Ford Accident Repair Centre using Genuine Ford parts fitted by Ford trained technicians following Ford repair methods.

Benefits to the Insurer include a reduction in the total cost of claims, transparent costs, a reduction in claims farming and rental charges. Right repair first time driving customer satisfaction and retention and reducing cycle times.